Statutory Table

Statutory compliance, in HR, refers to the legal framework within which organizations must operate, in the treatment of their employees. Every country has several hundreds of federal and state labour laws that companies need to align with. This list is forever being added to.

A lot of your company’s effort and money goes into ensuring compliance to these laws which could deal with a range of issues; from the payment of minimum wages to maternity benefits or professional taxes. Therefore, dealing with statutory compliance requires for companies to be well-versed with the various labour regulations in their country of operation.

Adhering to statutory compliances is necessary for all big and small companies in the world to keep their businesses safe from the legal trouble. A deep knowledge of statutory compliances is required to minimize the risk associated with the non-compliance of statutory requirements.

In today’s competitive and legal business world, it is very challenging for employers to manage statutory compliances without a good payroll management software . Each country has various kinds of compliance requirements. Thus BITPLUS PayMaster application handles all your statutory compliance requirement in very easy mode with 100% accuracy.

There are a number of statutory requirements for Kenyan companies and companies have to spend a significant amount of time in their payroll management to ensure that they are compliant with the legal regulations. If companies fail to adhere to statutory compliances, they may have to face heavy penalties which are several times more than complying with legal guidelines.

The common Statutory requirements that companies have to follow for their payroll management in Kenya are:

- NHIF Table

- "Pay As You Earn (PAYE)"

- Monthly IT Table

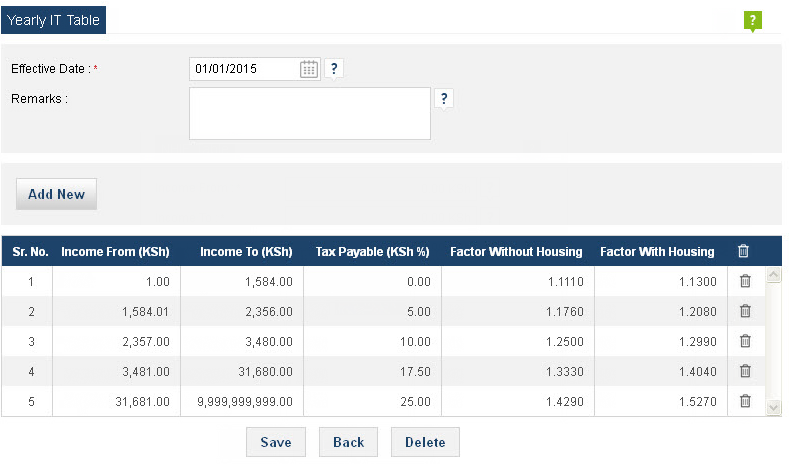

- Yearly IT Table

- NSSF Contribution

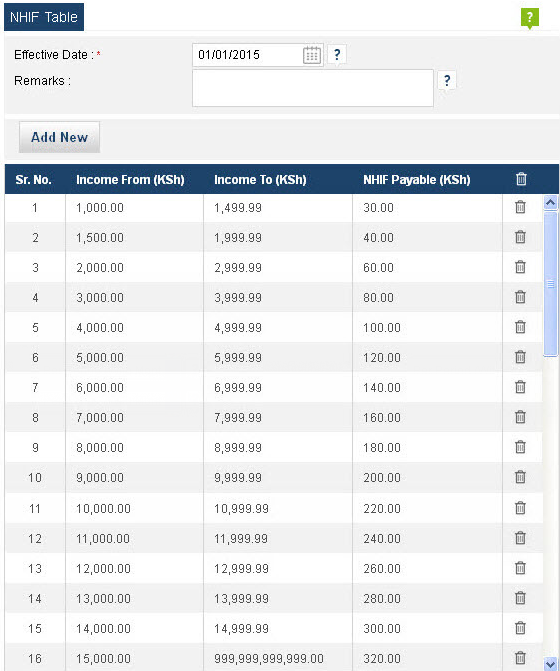

1: NHIF Table

NHIF registers all eligible members from both the formal and informal sector. For those in the formal sector, it is compulsory to be a member. For those in the informal sector and retires, membership is open and voluntary.

Use NHIF Table option to insert a range of NHIF payable amount into a different income range. items you define include parameters such as Effective Date, Remarks , Income From, Income To & NHIF Payable Amount.

Effective Date : if the tax rates change during the year, this date determines which set of tax rules the system uses. Usually rates change in January month but sometimes the government changes the tax rates later in the year. If that happens, you will receive an email notification from us informing you that an essential software update is available for download. The update will auto insert the new rate of all statutory tax tables as per government. You can also add the new rates by click on “Add New” button. Same as existing row data could be editable by double click on list row or deleted by pressing dustbin button.

Remarks : Use Remarks option for insert comments, description or additional information related to statutory tables.

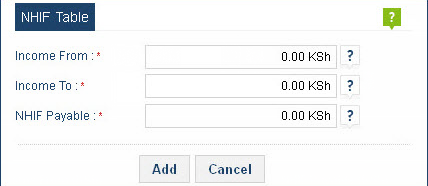

Add New : Click on “Add New” button to add a new value range in statutory table. When you click on this button a New pop-up window appear with option of Income From Range, Income to Range & NHIF Payable.

Edit the Existing Value : Double click on list row

Remove an entry from list : Click on dustbin icon

2: Pay As You Earn (PAYE)

The "Pay As You Earn" method of deducting income tax from salaries and wages applies to all income from any office or employment. Thus "Pay As You Earn" applies to weekly wages, monthly salaries, annual salaries, bonuses, commissions, directors' fees (whether the director is resident or non-resident) pensions paid to pensioners who reside in Kenya, where the amount from a registered pensions funds exceeds Kshs. 180,000 per annum and any other income from an office or employment. The system applies to all cash emoluments and all credits in respect of emoluments to employees accounts with their employers, no matter to what period they relate.

For calculating the PAYE amount of an employee there is two tax tables are exist in the system

- Monthly Tax Table

- Yearly Tax Table

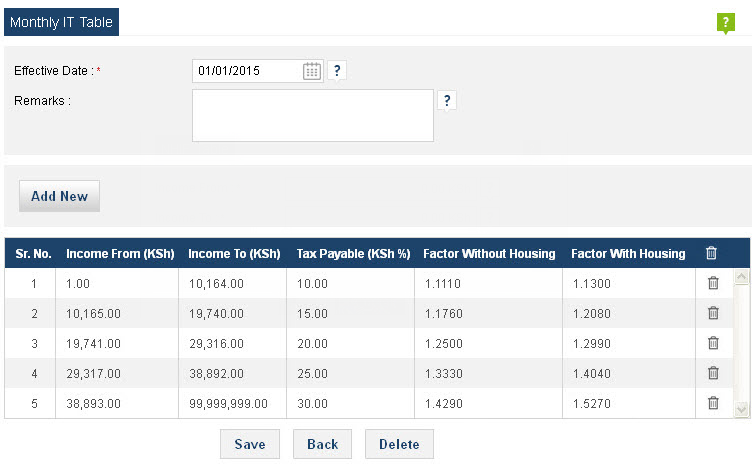

Monthly Tax Table:

Monthly tax tables will be used for all months during the year and will continue being used in subsequent years unless they are revised by the Minister.

Yearly Tax Table:

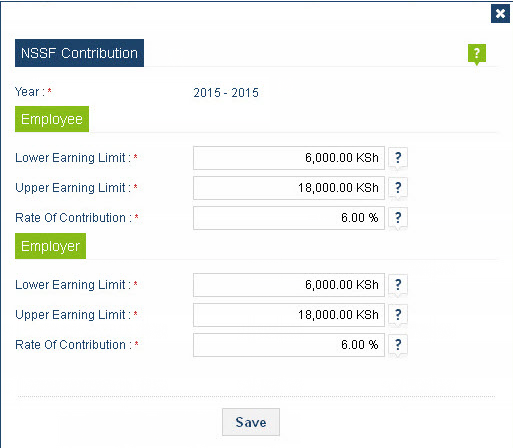

3: NSSF Contribution

The new NSSF Act came into effect on 10th January 2014. Under this act contributions to NSSF are divided into two tiers. To start with, both Tier I and Tier II contributions must be paid to the NSSF but there is a procedure for opting out of the latter.

The employee and employer each contribute 6% of pensionable pay to NSSF subject to certain limits for each tier. These limits will change each year. For the 2015 year they are as follows: