Regular Employee settings

Regular Payroll Settings:

Prorating any payment, including taxes, involves dividing the full amount due by a portion of a period of time. For example, a Kshs. 100 tax bill that covers one year would have a prorated six month value of Kshs. 50 and a prorated 8 month value of Kshs. 66.67. Prorated taxes can only occur when a taxpayer's liability reduces for some reason; in the following tax year, the taxpayer will be responsible for paying the full amount.

In BITPLUS PayMaster system provides 3 option to calculate TAX,NSSF & NHIF. These option are

- Per Period (with Monthly Prorata)

- Per Period (without Monthly Prorata)

- Last Period of Month.

Per Period (With Monthly Prorata) :

Option is applicable when more than 1 payroll period is exist in one month.

Example :

Assumed there is a 3 payroll period exist in June-2015 month.

- Payroll Period 1 : 01-June-2015 to 10-June-2015

- Payroll Period 2 : 11-June-2015 to 20-June-2015

- Payroll Period 3 : 21-June-2015 to 30-June-2015

An employee X Total Gross salary in Payroll Period 1 is Kshs. 12,000.so tax calculation would be

| Total Taxable Salary | 12,000.00 | |||||||||||

| Calculated Tax on Total Taxable Salary | 1,291.80 |

|

||||||||||

| Less : Monthly Relief | 1,162.00 | |||||||||||

| Tax Chargeable | 129.80 | Kshs |

|---|

An employee X Total Gross salary in Payroll Period 2 is Kshs. 20,000.so tax calculation would be

| Total Taxable Salary (Upto) | 32,000.00 | (12,000 Period 1 + 20,000 Period 2) | ||||||||||||||||||||

| Calculated Tax on Total Taxable Salary | 5,039.00 |

|

||||||||||||||||||||

| Less : Monthly Relief | 1,162.00 | Paid in Period 1 | ||||||||||||||||||||

| Less : Tax Paid Amount | 129.80 | Paid in Period 1 | ||||||||||||||||||||

| Tax Chargeable | 3,747.20 | Kshs |

|---|

An employee X Total Gross salary in Payroll Period 3 is Kshs. 30,000.so tax calculation would be

| Total Taxable Salary (Upto) | 62,000.00 | (12,000 Period 1 + 20,000 Period 2 + 30,000 Period 3) | |||||||||||||||||||||||||

| Calculated Tax on Total Taxable Salary | 13,694.40 |

|

|||||||||||||||||||||||||

| Less : Monthly Relief | 1,162.00 | Paid in Period 1 | |||||||||||||||||||||||||

| Less : Tax Paid Amount | 3,877.00 | (129.80 Period 1 + 3747.20 Period 2) | |||||||||||||||||||||||||

| Tax Chargeable | 8,655.40 | Kshs |

|---|

The same Calculation are used in NHIF Calculation & NSSF Calculation when choosing Per Period (With Monthly Prorata) option.

Per Period (Without Monthly Prorata) :

Example :

Assumed there is a 3 payroll period exist in June-2015 month.

- Payroll Period 1 : 01-June-2015 to 10-June-2015

- Payroll Period 2 : 11-June-2015 to 20-June-2015

- Payroll Period 3 : 21-June-2015 to 30-June-2015

An employee X Total Gross salary in Payroll Period 1 is Kshs. 12,000.so tax calculation would be

| Total Taxable Salary | 12,000.00 | |||||||||||

| Calculated Tax on Total Taxable Salary | 1,291.80 |

|

||||||||||

| Less : Monthly Relief | 1,162.00 | |||||||||||

| Tax Chargeable | 129.80 | Kshs |

|---|

An employee X Total Gross salary in Payroll Period 2 is Kshs. 20,000.so tax calculation would be

| Total Taxable Salary | 20,000.00 | ||||||||||||||||

| Calculated Tax on Total Taxable Salary | 2,504.80 |

|

|||||||||||||||

| Tax Chargeable | 2,504.80 | Kshs |

|---|

An employee X Total Gross salary in Payroll Period 3 is Kshs. 30,000.so tax calculation would be

| Total Taxable Salary | 32,000.00 | |||||||||||||||||||||

| Calculated Tax on Total Taxable Salary | 5,039.00 |

|

||||||||||||||||||||

| Tax Chargeable | 5,039.00 | Kshs |

|---|

The same Calculation are used in NHIF Calculation & NSSF Calculation when choosing Per Period (Without Monthly Prorata) option.

Last Period of Month :

Example :

Assumed there is a 3 payroll period exist in June-2015 month.

- Payroll Period 1 : 01-June-2015 to 10-June-2015

- Payroll Period 2 : 11-June-2015 to 20-June-2015

- Payroll Period 3 : 21-June-2015 to 30-June-2015

Payroll Period 3 : 21-June-2015 to 30-June-2015 is the Last Period.

An employee X Total Gross salary in Payroll Period 1 is Kshs. 12,000.so tax calculation would be

| Total Taxable Salary | 12,000.00 | |

| Calculated Tax on Total Taxable Salary | 0.00 | (Tax would be calculate in Last Period of month) |

| Tax Chargeable | 0.00 | Kshs |

|---|

An employee X Total Gross salary in Payroll Period 2 is Kshs. 20,000.so tax calculation would be

| Total Taxable Salary | 20,000.00 | |

| Calculated Tax on Total Taxable Salary | 0.00 | (Tax would be calculate in Last Period of month) |

| Tax Chargeable | 0.00 | Kshs |

|---|

An employee X Total Gross salary in Payroll Period 3 is Kshs. 30,000.so tax calculation would be

| Total Taxable Salary(Upto) | 62,000.00 | ||||||||||||||||||||||||||

| Calculated Tax on Total Taxable Salary | 13,694.40 |

|

|||||||||||||||||||||||||

| Tax Chargeable | 13,694.40 | Kshs | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Less : Monthly Relief | 1,162.00 | ||||||||||||||||||||||||||

| Tax Amount | 12,532.00 | Kshs |

The same Calculation are used in NHIF Calculation & NSSF Calculation when choosing Last Period of Month option.

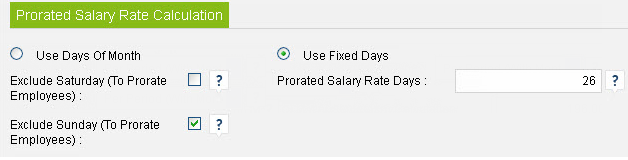

Prorated Salary Rate Calculation:

“Prorate Salary Rate Days” option is used to find the prorate basic salary when Employees Joining Date or separated date are mid of payroll period and fixed days option is applied for consider the value of it as Total month days. “Use Fixed Days” Option divide the employee basic salary by “Prorated Salary Rate Days” value for finding the per day basic salary.

Example:

An employee X joins the company on 17 January 2015 with Basic salary of 45000 Kshs. BITPLUS PayMaster calculate his or her prorated basic salary (45000/26) * 15 = 25,961.53 Kshs.

where

- 45000 Kshs. = Basic Salary for the month

- 26 = Value of Prorated Salary Rate Days

- 15= Remaining Days of the Month (From 17 January 2015 to 31 January 2015)

“Use Days of Month” option consider the Total days of month for divide the employee basic salary for finding the per day basic salary.

Exclude Saturday (To Prorate Employees) : when checked,exclude all Saturday’s of that month in counting of total days of month.

Exclude Sunday (To Prorate Employees) : when checked,exclude all Sunday’s of that month in counting of total days of month.

Example:

An employee X joins the company on 17 January 2015 with Basic salary of 45000 Kshs.

- When Exclude Saturday & Exclude Sunday option is unchecked

- 45000 Kshs. = Basic Salary for the month

- 31 = Total month days (January-2015)

- 15 = Remaining Days of the Month (From 17 January 2015 to 31 January 2015)

Prorate basic salary = (45000 / 31) * 15 = 21774.19 Kshs

Where - When Exclude Saturday is checked & Exclude Sunday option is unchecked

- 45000 Kshs. = Basic Salary for the month

- 26 = Total month days – No. of Saturdays of the January 2015 month (31 – 5)

- 15 = Remaining Days of the Month (From 17 January 2015 to 31 January 2015)

Prorate basic salary = (45000 / 26) * 15 = 25961.53 Kshs

Where - When Exclude Saturday is unchecked & Exclude Sunday option is checked

- 45000 Kshs. = Basic Salary for the month

- 27 = Total month days – No. of Sunday’s of the January 2015 month (31 – 4)

- 15 = Remaining Days of the Month (From 17 January 2015 to 31 January 2015)

Prorate basic salary = (45000 / 27) * 15 = 25000 Kshs

Where - When Exclude Saturday & Exclude Sunday both option are checked

- 45000 Kshs. = Basic Salary for the month

- 22 = Total month days – Total Sunday’s + Saturday’s of the Jan 2015 month (31 – 9)

- 15 = Remaining Days of the Month (From 17 January 2015 to 31 January 2015)

Prorate basic salary = (45000 / 22) * 15 = 30681.81 Kshs

Where

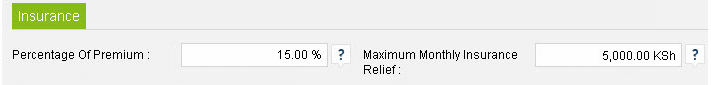

Insurance:

A resident individual shall be entitled to insurance relief at the rate of 15% of premiums paid subject to maximum relief amount of Kshs. 5,000 per month (or Kshs. 60,000 per annum)

- he has paid premium for an insurance made by him on his life, or the life of his wife or of his child and that the Insurance secures a capital sum, payable in Kenya and in the lawful currency of Kenya. or

- his employer paid premium for that insurance on the life and for the benefit of the employee which has been charged to tax on that employee. or

- both employee and employer have paid premiums for the insurance.

if he proves that:-

Example:

An employee X has furnished a Life Assurance Policy Certificate showing annual premiums payable of Kshs. 48,000.

The commencement date of the policy is 1st January, 2003. The insurance relief allowable in the payroll from the month of January will be calculated Kshs. 48,000 x 15% = 7,200 per annum i.e. 600 per month which will be entered in the appropriate column of Tax Deduction Card (P9A).

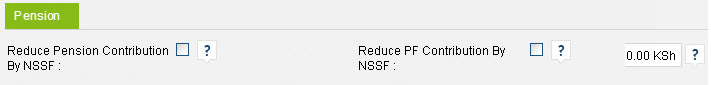

Pension:

Reduce Pension Contribution by NSSF : Click the option for reduce the calculated PENSION amount by the value of calculated NSSF.

Reduce PF Contribution by NSSF : Click the option for reduce the calculated PF amount by the value of calculated NSSF.

HOSP Settings:

An employee shall in any year of income commencing on or after 1st January, 1999 be eligible to a deduction up to a maximum of Kshs. 4,000 /- (Four thousand Kshs) per month or Kshs. 48,000/- per annum in respect of funds deposited in “approved Institution” under "Registered Home Ownership Savings Plan", in the qualifying year and the subsequent nine years of income.

“Approved Institution" - Means a Bank or financial institution registered under the Banking Act, an Insurance Company licensed under the Insurance Act or a Building Society registered under the Building Societies Act".

Arrears Calculation Settings:

General option for customize Arrears calculation according to the company policies and choice.

| Option Name | Description |

|---|---|

| Calculate Arrears on Tax | When checked system calculate arrears on TAX |

| Calculate Arrears on NHIF | When checked system calculate arrears on NHIF |

| Calculate Arrears on PF | When checked system calculate arrears on PF |

| Calculate Arrears on NSSF | When checked system calculate arrears on NSSF |

| Calculate Arrears on Pension | When checked system calculate arrears on Pension |

| Calculate Arrears on HRA | When checked system calculate arrears on HRA |

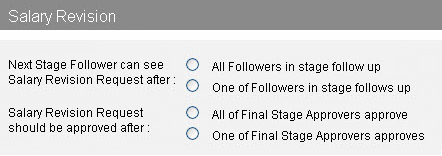

Salary Revision:

System settings for Decision stand to accepting records as a verified data for process Salary Revision

when All of stage is approved or one of stage is approved. & Next stage follower can see salary revision request after all followers in stage follow up or one of followers in stage follows up.