Common Settings

Common:

Option Name and Description

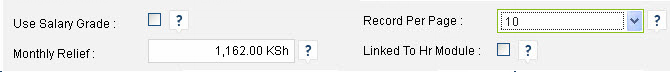

- Use Salary Grade : A salary grade form can contain a salary scale. Salary grade structures are the basic underlying element of Employee remuneration. They are simple, easy to understand and use, and effective. When “Use Salary Grade” option is checked in payroll setting and item is selected from Salary Grade combo in Employee Remuneration, system consider the Selected Salary Grade Item Basic, HRA, Pension, PF, Fixed Earning & Deduction as employee Basic, HRA, Pension, PF & Earning deduction for payroll calculation.

- Monthly Relief : Monthly Relief also knows as Personal Relief. Every individual in receipt of income liable to tax is entitled to a relief, knows as "Personal Relief". A resident individual with taxable income is entitled to a personal relief of Kshs. 1162/- per month with effect from 1st January 2005 (i.e. Kshs. 13,994/- per annum). This is a uniform relief and employers are advised to automatically grant personal relief to all employees irrespective of their marital status. In Payroll calculation Personal relief less the value of tax charged amount by its value i.e. Kshs. 1162/-

Individual serving several employees qualify for personal relief from only one employer (i.e., main employment). - Record Per Page : Number of rows to display on a single page when using pagination. The end user will be able to override the value by choosing the new value from combo between 10, 20, 30, 40 & 50.

- Linked to HR Module : Option for link PayMaster application to BITPLUS HR application.

NSSF Calculation:

The National Social Security Fund (NSSF) was established in 1965 through an Act of Parliament Cap 258 of the Laws of Kenya. The Act was established as a mandatory national scheme whose main objective was to provide basic financial security benefits to Kenyan upon retirement. The Fund was set up as a Provident Fund providing benefits in the form of a lump sum.

NSSF As Per 5% or 200 Ksh Max. Rule

NSSF Contributions are set at 10% of monthly gross income up to a maximum of Kshs. 400 per month, half paid by the employer and the balance by the employee. (i.e. 5% of monthly gross income up to maximum of Kshs. 200 per month, paid by employer and employee).

Example:

| Employer's salary | Kshs. 10,000 |

| NSSF as Per 5% of Earn salary | Kshs. 500 |

Calculate NSSF Kshs. 500 is greater than Kshs. 200. Rules says NSSF as per 5% or 200 Ksh Maximum. Hence NSSF is charged as Kshs 200 by system as per this rule.

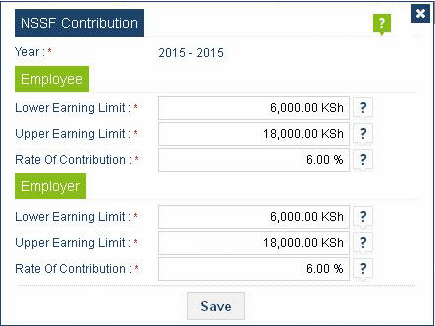

NSSF As per Kenya Gazette Supplement No. 179 (Acts No. 45)

The National Social Security Fund (NSSF) ACT No. 45 of 2013 was assented on 24 December 2013 with the effective date of commencement being 10 January 2014

For the purposes of the Act, the Upper Earning Limit (UEL) will be Kshs. 18,000 while the Lower Earnings Limit (LEL) will be Kshs. 6,000. The pension contribution will be 12% of the pensionable wages made up of two equal portions of 6% from the employee and 6% from the employer subject to an upper limit of Kshs. 2,160 for employees earning above Kshs. 18,000.

(For more know about NSSF Contribution refer Setp 7 Statutory Table)

The employee contribution shall be drawn directly from his or her salary and wages while the employers contribution shall come directly from the employer.

The contributions relating to the earnings below the LEL of the earnings (a maximum of Kshs. 720) will be credited to what will be known as a Tier I account while the balance of the contribution for earnings between the LEL and the UEL (up to a maximum of Kshs. 1,440) will be credited to what will be known as a Tier II account.

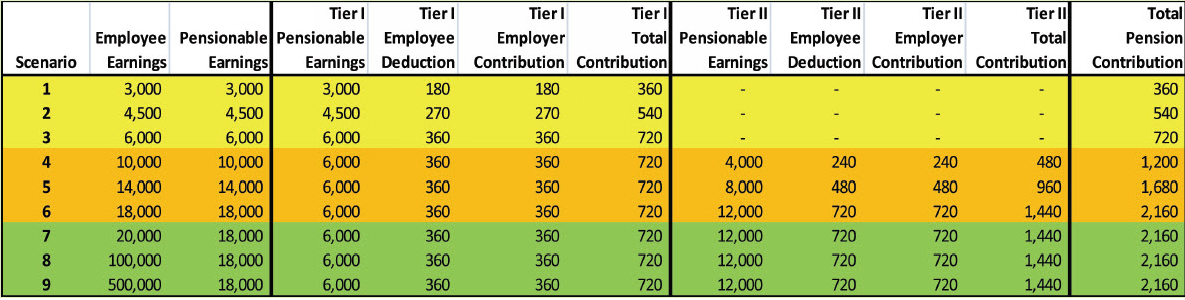

Lets clear this act by an example. Assumed an employee X Total Gross salary in Payroll Period is Kshs. 10,000. So NSSF calculate as per Kenya Gazette Supplement No. 179 (Acts No. 45) Rule would be

Example:

| Employer's salary | Kshs. 10,000 |

| Lower Earning Limit | Kshs. 6000 |

| Rate of Contribution | 6% |

Kshs. 10,000 is greater than Lower Earning Limit Kshs. 6,000. Hence NSSF Calculation (TIER 1) would be calculated on Kshs. 6,000.

| NSSF (TIER 1) calculation Amount | Kshs. 6,000 |

| NSSF (TIER 1) Contribution | Kshs. 720 |

| by Employee | 360 (Kshs. 6,000 * 6%) |

| by Employer | 360 (Kshs. 6,000 * 6%) |

Kshs. 6,000 is used in to calculate NSSF (TIER 1) amount. Remaining amount are used in calculation of NSSF (TIER 2) Amount.

| NSSF (TIER 2) calculation Amount | Kshs. 4,000 (Kshs. 10,000 – Kshs. 6,000) |

| NSSF (TIER 2) Contribution | Kshs. 480 |

| by Employee | 240 (Kshs. 4,000 * 6%) |

| by Employer | 240 (Kshs. 4,000 * 6%) |

| Total NSSF Amount charged | Kshs. 1,200 |

|---|---|

| TIER 1 | Kshs. 720 |

| TIER 2 | Kshs. 480 |

Sample Computations are attached below for ease of reference:

“Fixed NSSF Deduction for Regulars” on checked system allow to accept value in “Fixed NSSF Deduction Amount for Regulars :” text box and consider the input value as Fixed NSSF Amount of Employee & “Fixed NSSF Deduction for Regulars” on checked system allow to accept value in “Fixed NSSF Deduction Amount for Regulars :” text box and consider the input value as Fixed NSSF Amount of Employee & Employer for Regular employees without performing any action for calculate NSSF Amount.

“Fixed NSSF Deduction for Casual” on checked system allow to accept value in “Fixed NSSF Deduction Amount for Casuals :” text box, consider the input value as NSSF Amount of Employee & Employer for casual employees without performing any action for calculate NSSF Amount.

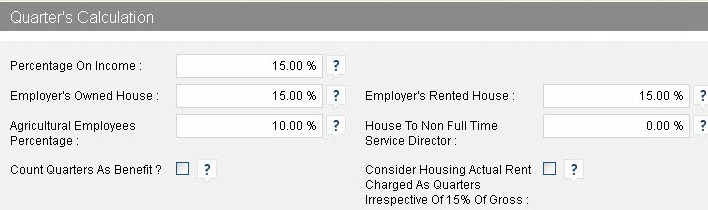

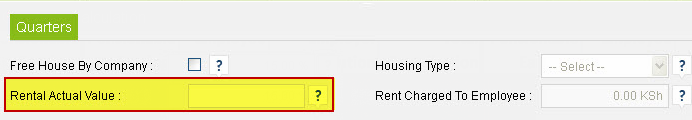

Quarter's Calculation:

The Quarter's benefit for a employee shall be the higher of 15% of total income (or employment income, in case of whole time service director), the fair market rental value and the actual rent paid by the employer. For Agricultural Employees the higher rate is 10%.

| Option Name | Description |

|---|---|

| Count Quarters As Benefit : | When checked added calculated Quarters value in calculated total benefit in payroll calculation |

| Consider Housing Actual Rent Charged As Quarters Irrespective of 15% Gross: | When checked system consider the "Rental Actual Value :" as a calculated Quarters amount. "Rental Actual Value :" option exits in "Quarter’s Tab" of Employee Detail. |

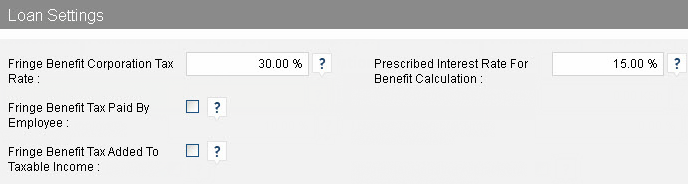

Loan Settings:

When employer provides loan to an employee and charges interest which is below the prescribed rate of interest of government, then the difference between the prescribed rate and employer's loan rate is a benefit from employment chargeable to tax on the employee. The benefit is computed as the difference between the interest charged by employer and prescribed rate of interest of government. Low interest rate employment benefit provisions will also apply to a director and will continue to apply even after the employee or director has left employment as long as the loan remains unpaid.

Tax known as Fringe Benefit tax was introduced by new provisions under Section 12B of the Income Tax Act. It is payable by the employers commencing on the 12th June, 1998 in respect of loan provided to an employee, director or their relatives at an interest rate lower than the market interest rate. The taxable value of Fringe Benefit is determined as follows:-

In case of loans provided after 11th June, 1998 or loan provided on or before 11th June, 1998 whose terms and conditions have changed after 11th June, 1998, the value of Fringe Benefit shall be the difference between the interest that would have been payable on the loan if calculated at the market interest rate and the actual interest paid.

Example:

| Employer's loan amount | Kshs. 2,100,000 |

| Interest charged to employee | 12% Annual (i.e. 1% Monthly) |

| Market Interest rate for | 15% Annual (i.e. 1.25% Monthly) |

Calculation of Fringe Benefit Tax:-

Fringe Benefit is (15 - 12 = 3%) Kshs. 2,100,000 x 3% = Kshs. 63,000 per annum, i.e. Kshs. 5,250 per month.

Fringe Benefit tax payable by employer is Kshs. 5,250 x 30% = Kshs. 1575/- (for the month).

| Option Name | Description |

|---|---|

| Fringe Benefit Tax Paid By Employee | If Checked Fringe Benefit tax charged & deducted from Employee salary. |

| Fringe Benefit Tax Added To Taxable Income | If checked Fringe Benefit Tax added in taxable income. |

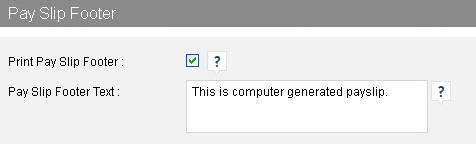

Pay Slip Footer:

Use to print message, information,news,greetings on employee's payslip hard copy.

Advance Limit:

This is a Deduction amount limit, deducted from total gross income as a Salary Advance. Advance limit accept numeric value from 1 to 100 as %.

A salary advance is a request for salary payments in advance of any normal pay period;regardless of whether repayment is linked to a borrowers pay day, it may be granted only on an emergency basis and after an employee has exhausted all other options or available recourse ( a payment for work that is given before the work is complete)

Advance here means it’s a payment made or given ahead of time (an advance payment) Emergency means unforeseen event which may involve medical and life or safety situation that are beyond an employee’s control.

Tax Relief:

Monthly Relief/Personal Relief carry forward is option when checked carry forward unutilized personal relief to next month. Unutilized personal relief can be carried forward from one month to another within the same calendar year but not from one year to another.

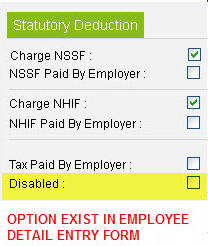

Disabled Employees Relief : Based on Section 12 (3) of the Persons with Disability Act, 2003 the tax-exemption policy qualifies that for disabled persons, the first 150,000 shillings of their total income per month is exempt from tax.

When employee marked a Disabled in employee information, while payroll calculation system consider his or her relief as value of “Disabled Employees Relief :” option rather than Monthly Relief.

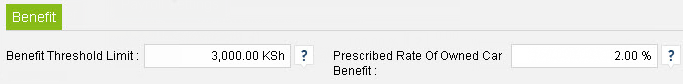

Benefit:

| Option Name | Description |

|---|---|

| Benefit Threshold Limit | Where an employee enjoys a benefit, advantage or facility of whatsoever nature in connection with employment or services rendered; the value of such benefit should be included in employee’s earnings and charged to tax. The minimum taxable aggregate value of a benefit, advantage or facility is Kshs. 3,000 per month or Kshs. 36,000 per annum. |

| Prescribed Rate of Owned Car Benefit | Where an employee is provided with a motor vehicle by employer, the chargeable benefit for private use shall be the higher of the rate determined by the Commissioner and the prescribed rate of benefit. Where such vehicle is hired or leased from third party, employees shall be deemed to have received a benefit in that year of income, equal to the cost of hiring or leasing. The “prescribed rate of benefit” means the rates for each month on the initial cost of the vehicle |

Other:

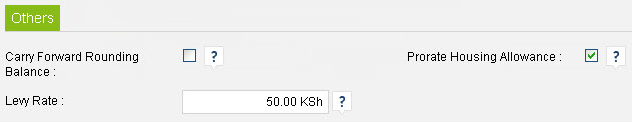

“Carry Forward Rounding Balance” option forward the rounding balance to next month. Rounding balance can be carried forward from one month to another within the same calendar year but not from one year to another.

Levy Rate : Option for to enter National Industrial Training Authority (NITA) Levy Rate of per employee per month.

Prorate Housing Allowance : to being charged or receiving part or proportion of housing allowance in your payroll calculation. Pro-rata billing will apply if:

- Employee Join in mid of payroll period

- Employee separated in mid of payroll period

- Housing allowance is started to employee in mid of payroll period

- Employee is Blacklisted in mid of payroll period

- Employee put on HOLD in mid of payroll period

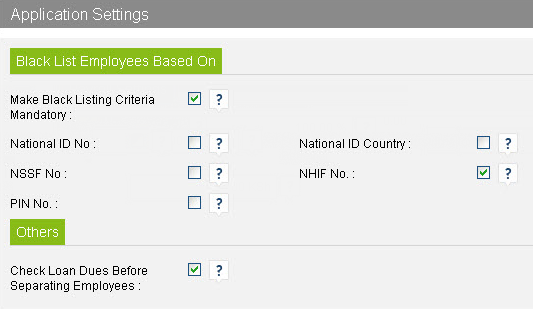

Application Settings:

| Option Name | Description | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Make Black Listing Criteria Mandatory | Option when checked ,make the following field is mandatory in Employee Detail Entry form when unchecked system accept blank value.

|

||||||||||

| Check Loan Dues Before Separating Employees | When checked system does not allow to separate employee whose company loan instalment is still pending for finalize or paid. When unchecked system does not check employee loan due balance on separation entry. |

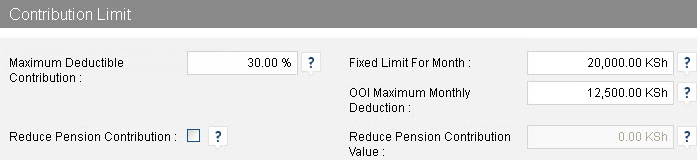

Contribution Limit:

Fixed Limit for Month : Contributions made to the National Social Security Fund (NSSF) qualify as a deduction with effect from 1st January, 1997. Where an employee is a member of a pension scheme or provident fund and at the same time the National Social Security Fund (NSSF) the maximum allowable contributions should not exceed Kshs. 20,000 per month in aggregate.

Maximum Deductible Contribution : Contributions to Individual Retirement Fund percentage rate is 30% of pensionable income of the individual to be in line with employer registered retirement schemes. The allowable deduction shall be the lesser of:- (i) The actual contribution made by the individual. (ii) 30% of pensionable income. (iii) Kshs. 20,000 per month (or Kshs. 240,000 per annum)

OOI Maximum Monthly Deduction : In ascertaining the total income of a person for a year of income interest paid on amount borrowed from specified financial institution shall be deductible. The amount must have been borrowed to finance either:- (i) the purchase of premises or (ii) improvement of premises - which he occupies for residential purposes. The amount of interest allowable under the law must not exceed Kshs. 150,000 per year (equivalent to Kshs. 12,500 per month).

Reduce Pension Contribution : if checked, reduce Pension Amount by “Reduce Pension Contribution value”

Email Settings:

With BITPLUS PayMaster Payroll, you can send your employees' payslips by email, saving your time and money. Automated Payslips reduces the burden of producing and posting payslips. At the click of a button, you can automatically produce payslips and have them:

- Delivered to your employees online or

- Sent by post to your company address, so that you can distribute them internally. (if you have more than 1 unit and payroll is calculate on main unit)

We know that everyone's different, so to make it as flexible and convenient as possible, you can specify the delivery preference for each employee by choosing their preferred email type for mail communication from personal & official email address. System automatically get the email address from Employee Detail's and BITPLUS PayMaster auto mail service do further process to mail payslip. This is all automated and means you can get on with completing your payroll rather than handing out or posting payslips

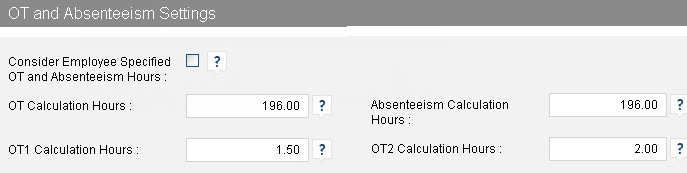

OT and Absenteeism Settings:

Overtime (OT1) rate is calculated by multiplying the employee’s normal rate by 1.5.

Double overtime rate (OT2) is calculated by multiplying the employee’s normal rate by 2.

An employee will receive overtime pay if their period hours exceed the working hour threshold. “OT Calculation Hours” setting are used in calculation to get the overtime (OT1) & Double overtime (OT2) rate. For consider employee specified OT and Absenteeism hours setting please check the option captioned “Consider Employee Specified OT and Absenteeism Hours”

Same as “Absenteeism Calculation Hours” option are used in calculation to get the Absenteeism Rate.