Master Creation

Master data management (MDM) is a comprehensive method of enabling an enterprise to link all of its critical data to one file, called a master data file, that provides a common point of reference.

Master data file is the core data that is essential to operations in a specific business or business unit. Its represents the business objects which are agreed on and shared across the enterprise. This is a single source of basic business data some time used across multiple systems, applications, and/or processes. The no of Master data file exits in BITPLUS PayMaster Version 1.0.0.1 are

- Department

- Sub Department

- Designation

- Occupation

- Category

- Class

- Company Calender

- Holiday

- Wages Rate

- Salary Grade

- Loan Setup

- Benefit Group

- Benefit

- Banks

- Bank Setup

- Bank Branch Setup

- Earning Deduction

- Earning Setup

- Deduction Setup

- Formula Masters

- Earning Deduction Profile

- Earning Deduction Profile Assignment

- Security

- User Roll

- Users

- Bank Transfer

- Bank Transfer Template

- Bank Transfer Settings

- Bank Transfer Export

- Currency

- Currency Exchange Rate

- Password Policy

- Coinage Setup

- Rounding

- Opening Balances

- Organization Category

- Reporting Structure

- Organization Unit

- User Delegation

- Lookup Data

- Email Template

- Auto Numbering Setup

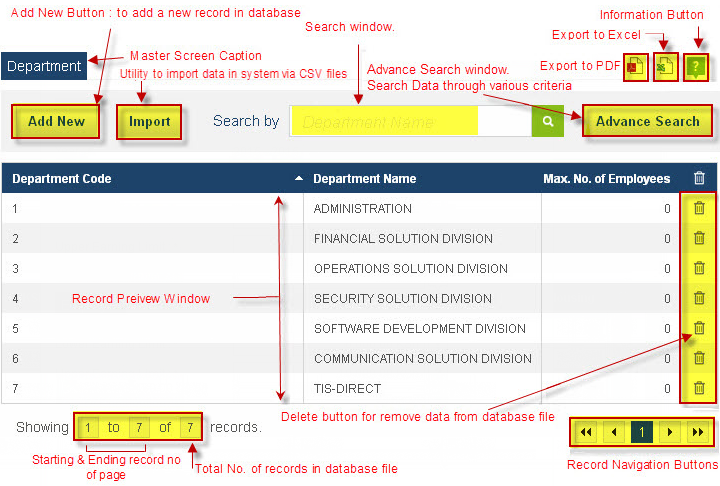

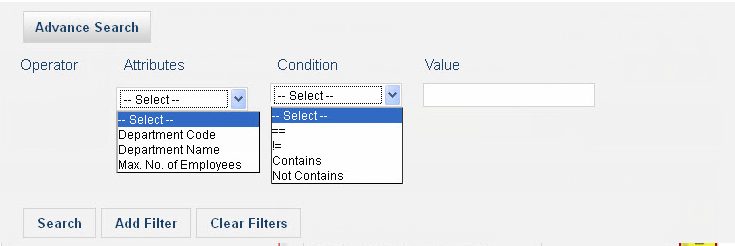

Master Data - Main Screen

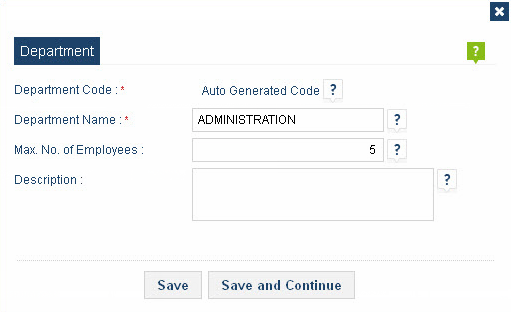

Department:

A department is a division of employees in your organization. Departments may reflect your organization's hierarchical structure, geographic regions, or functional groups. Users can be assigned to one department only. You can create multiple department.

The application uses department to control employees joining. Defines the structure and characteristics for each department you use within the company.

| Option Name | Description |

|---|---|

| Department Code | Mandatory and unique field. Enter a new department code, or the number assigned to the existing department master record being maintained. System is having mechanism to generated auto as well as user can enter desired value for department code. Value can be acceptable as numeric, alpha numeric with prefix and suffix. (for know how to enter desired value in code text box please refer Auto Numbering Setup master.) |

| Department Name | Name of the department. It is a mandatory field, could not accept blank & duplicate value. |

| Max. No. OfEmployees | No. of active employee can works in this department. Option reflects message or information when active employee are exceed in this department from this limit. Option work when system are linked with BITPLUS HR module. |

| Description | A option for store any other information,remarks or description. |

Save : Click on “Save” button to save the data in master database file.

Save and continue : one of the most highly anticipated features in BITPLUS PayMaster version 1.0.0.1 is the “Save and Continue”. This allows users to begin filling out a form, save their data, and remain on the form for add a new record.

We put a lot of thought into how the save and continue feature would work in order to ensure it provided a good experience for the end user and made it easy for them to begin, save, and continue the form. The end result will be more form submissions for you. Save and continue form functionality is very handy for situations where you have to input very long data.

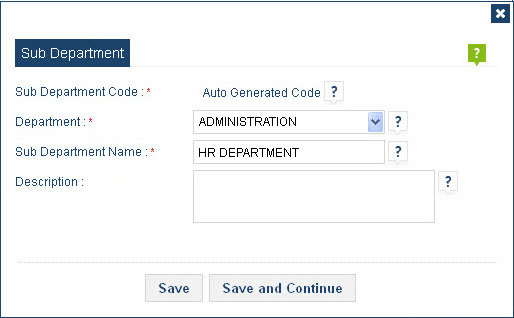

Sub Department:

Sub-departments are second tier navigation after departments. You can enter the primary information for each sub department through this program. Use sub department to add, update and delete sub department available in the company. Items you define include parameters such as department, sub department name and description.

| Option Name | Description |

|---|---|

| Sub Department Code | Mandatory and unique field. Enter a new sub department code, or the number assigned to the existing sub department master record being maintained. System is having mechanism to generated auto as well as user can enter desired value for sub department code. Value can be acceptable as numeric, alpha numeric with prefix and suffix. |

| Department | List of available department of the company. |

| Sub Department Name | Name of the sub department. It is a mandatory field, could not accept blank & duplicate value. |

| Description | A option for store any other information,remarks or description. |

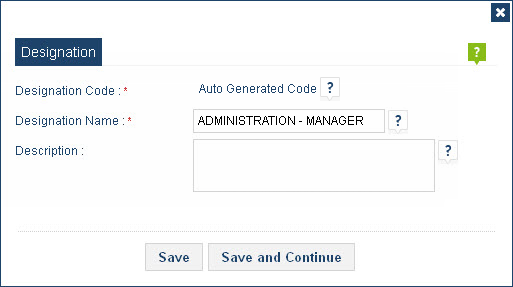

Designation:

Designation is the act of pointing someone out with a name, a title or an assignment. It is an appointment, selection, or classification of an individual into a different category from the others.

The designation master is responsible for creating new designations in the organization. You can enter the primary information for each designation master through this program. Use designation to add, update and delete designation available in the company. Items you define include parameters such as designation code,designation name and description.

| Option Name | Description |

|---|---|

| Sub Department Code | Mandatory and unique field. Enter a new designation code, or the number assigned to the existing designation master record being maintained. System is having mechanism to generated auto as well as user can enter desired value for designation code. Value can be acceptable as numeric, alpha numeric with prefix and suffix. |

| Designation Name | Name of the designation. It is a mandatory field, could not accept blank & duplicate value. |

| Description | A option for store any other information,remarks or description. |

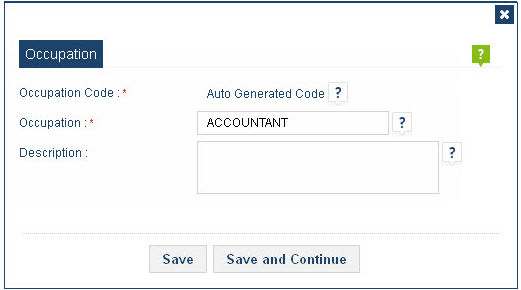

Occupation:

Use occupation option to add employees family member occupation. This feature is available in application when it is attached with BITPLUS HR module. Each occupation defines the primary information needed to use it in other transaction. An occupation record contains the key details about the occupation, such as its name and description. This information is then leveraged by the BITPLUS HR application for any transaction conducted using this occupation.

You can enter the primary information for each occupation master through this program. Use occupation to add, update and delete occupation available in the company. Items you define include parameters such as occupation code, occupation and description.

| Option Name | Description |

|---|---|

| Occupation Code | Mandatory and unique field. Enter a new occupation code, or the number assigned to the existing occupation master record being maintained. System is having mechanism to generated auto as well as user can enter desired value for occupation code. Value can be acceptable as numeric, alpha numeric with prefix and suffix. |

| Occupation | Name of the occupation. It is a mandatory field, could not accept blank & duplicate value. |

| Description | A option for store any other information,remarks or description. |

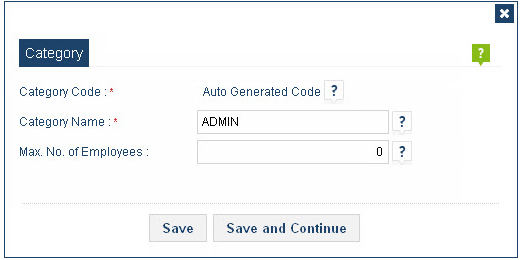

Category:

Category are third among the four tier navigation, after department & sub-department. Category is a division of people or things regarded as having particular shared characteristics. Use category to enter and manage employee category. You can use this option to selection or classification of an employee into a different categories. Along with enter, update, and delete transactions related to employee category.

You can enter the primary information for each category through this program. Items you define include parameters such as category name as well as its description. Use category to add, update and delete designation available in the current company.

| Option Name | Description |

|---|---|

| Category Code | Mandatory and unique field. Enter a new category code, or the number assigned to the existing category master record being maintained. System is having mechanism to generated auto as well as user can enter desired value for category code. Value can be acceptable as numeric, alpha numeric with prefix and suffix. |

| Category Name | Name of the category. It is a mandatory field, could not accept blank & duplicate value. |

| Max. No. of Employees | No. of active employee can works in this category. Option reflects message or information when active employee are exceed in this category from this limit. Option work when system are linked with BITPLUS HR module. |

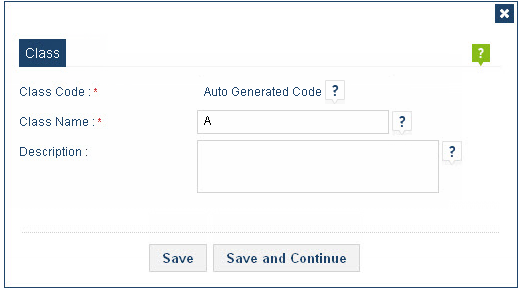

Class:

Class are the fourth and last tier navigation, after department,sub-department and category. Use class to enter one more level segregation of employee for reporting. Class is a group of employees sharing the same economic and social status also having common attributes.

Use class to add, update and delete designation available in the current company. You can enter the primary information for each class through this program. Items you define include parameters such as class code, class name & description.

| Option Name | Description |

|---|---|

| Class Code | Mandatory and unique field. Enter a new class code, or the number assigned to the existing class master record being maintained. System is having mechanism to generated auto as well as user can enter desired value for class code. Value can be acceptable as numeric, alpha numeric with prefix and suffix. |

| Class Name | Name of the class. It is a mandatory field, could not accept blank & duplicate value. |

| Description | A option for store any other information,remarks or description. |

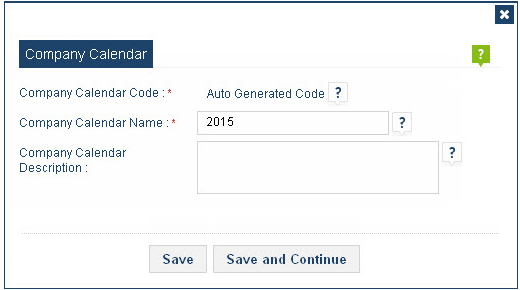

Company Calender:

Use company calendar master to enter and update each calendar in which your organization conducts business. Company calendar contains past and future company related information. A calendar should include holidays dates for company, case studies, news releases, blog articles and other forms of content.

Each calendar record defines the primary information needed to take decision about company holiday, case studies and news releases. A calendar record contains the key details about the calendar, such as its name and its description. This information is then leveraged by the application for future uses.

Company calendar option appear & works when system are linked with BITPLUS HR module

| Option Name | Description |

|---|---|

| Company Calendar Code | Mandatory and unique field. Enter a new company calendar code, or the number assigned to the existing company calendar master record being maintained. System is having mechanism to generated auto as well as user can enter desired value for company company code. Value can be acceptable as numeric, alpha numeric with prefix and suffix. |

| Company Calendar Name | Name of the company calendar. It is a mandatory field, could not accept blank & duplicate value. |

| Company Calendar Description | A option for store any other information,remarks or description. |

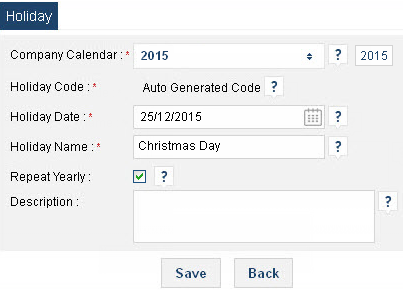

Holiday:

The holidays are the days when every employee is entitled for paid day of one despite the work day is zero. This form is used to add and delete holidays and update holiday information such as dates that are holidays for your organization.

Use holiday to enter and manage holidays for the current company year. You can enter the primary information for each company holiday through this program. Items you define include parameters such as company calendar, holiday code, holiday date, holiday name, yearly repeated flag and description. Use holiday to add, update and delete holiday date available in the current company.

Holiday option appear & works when system are linked with BITPLUS HR module

| Option Name | Description |

|---|---|

| Company Calendar | List of company calendar exist in company. |

| Holiday Code | Mandatory and unique field. Enter a new holiday code, or the number assigned to the existing holiday master record being maintained. System is having mechanism to generated auto as well as user can enter desired value for holiday code. Value can be acceptable as numeric, alpha numeric with prefix and suffix. |

| Holiday Date | Mandatory and unique field. You can enter any date belongs to login financial year for holiday. Once a holiday exist on date you can not enter other holiday for that date. |

| Holiday Name | Name of the holiday. It is a mandatory field, could not accept blank & duplicate value. |

| Repeat Yearly | Flag for maintain its repeating entry for yearly basis. |

| Description | A option for store any other information,remarks or description. |

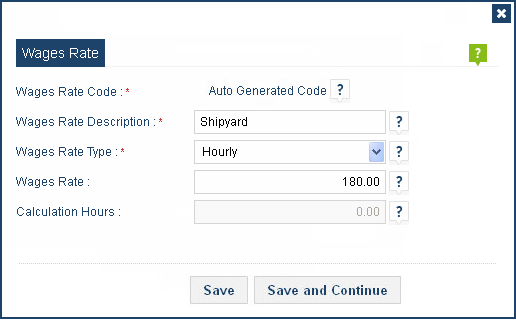

Wages Rate:

Use wages rate option to add casual employees daily or hourly wage rate. This feature is available when you have casual employee feature in your license. Each wages rate master defines the primary information needed to use it in other transaction. A wages rate record contains the key details about the casual employee wages detail, such as its wages rate code,wages rate description,wages rate type, wages rate & calculation hours. This information is then leveraged by the application for any transaction conducted using this wages rate master in casual employees.

You can enter the primary information for each wages rate master through this program. Use wages rate master to add, update and delete wages rate record available in the company.

| Option Name | Description |

|---|---|

| Wages Rate Code | Mandatory and unique field. Enter a new wages rate code, or the number assigned to the existing wages rate master record being maintained. System is having mechanism to generated auto as well as user can enter desired value for wages rate code. Value can be acceptable as numeric, alpha numeric with prefix and suffix. |

| Wages Rate Description | Name of the wages rate. It is a mandatory field, could not accept blank & duplicate value. |

| Wages Rate Type | Selection option for wages rate between “daily” or “hourly”. Application consider the value of wages rate option as daily or hourly from this option. When choose daily application multiple the wages rate value with casual employee attendance to compute his or her basic salary, while on choose hourly system multiply the wages rate value with casual employee hourly attendance to compute the basic salary. |

| Wages Rate | Wages rate of employee. Accept only numeric value. Value can be 0. |

| Calculation Hours | Calculation hours option does not include in any calculation by application but it is listed in formula list. You can use it in various formula and can get your desired calculation or result. (to know more about how to create or formula please refer Formula Masters under earning deduction master. |

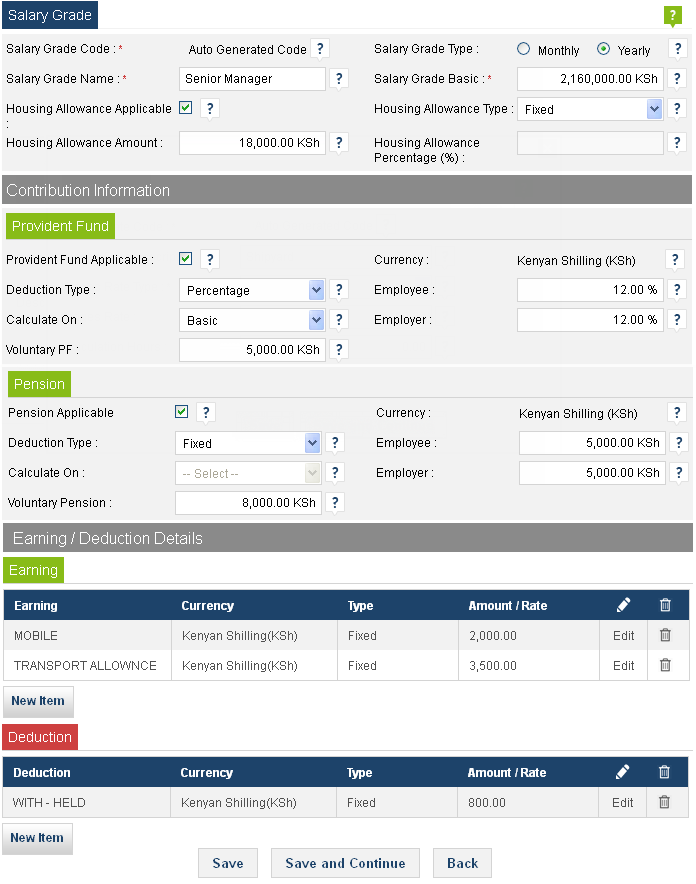

Salary Grade:

Salary grade also knows as pay grade. A salary/pay grade is a unit in systems of monetary compensation for employment. It is commonly used in public & private companies. Pay grades facilitate the employment process by providing a fixed framework of salary ranges, as opposed to a free negotiation. Typically, pay grades encompass two dimensions: a "vertical" range where each level corresponds to the responsibility of, and requirements needed for a certain position; and a "horizontal" range within this scale to allow for monetary incentives rewarding the employee's quality of performance or length of service. Thus, an employee progresses within the horizontal and vertical ranges upon achieving positive appraisal on a regular basis. In most cases, evaluation is done annually and encompasses more than one method.

As earlier described a salary grade form can contain a salary scale. Salary grade structures are the basic underlying element of employee remuneration. They are simple, easy to understand and use, and effective. When “Use Salary Grade” option is checked in payroll setting and item is selected from salary grade combo in employee remuneration, system consider the selected salary grade item basic, HRA, pension, PF, fixed earning & deduction as employee basic, HRA, pension, PF & earning deduction for payroll calculation.

| Option Name | Description |

|---|---|

| Salary Grade Code | Mandatory and unique field. Enter a new salary grade code, or the number assigned to the existing salary grade master record being maintained. System is having mechanism to generated auto as well as user can enter desired value for salary grade code. Value can be acceptable as numeric, alpha numeric with prefix and suffix. |

| Salary Grade Type | There are two option exist for salary grade type. Choose your salary grade type as monthly or yearly, depending on your needs. If you decide to switch to yearly all the values you put in salary grade option are divide by 12 to convert it on monthly basis before application use it in payroll calculation. |

| Salary Grade Name | Name of the salary grade. It is a mandatory field, could not accept blank & duplicate value. |

| Salary Grade Basic | Basic salary range of this grade. Accept only numeric values. 0 can be acceptable by application. |

>>HOUSING ALLOWANCE:

| Housing Allowance Applicable | Option for making decision about housing allowance applicable for this salary grade. When clicked all the option related housing allowance are enable for enter a new value or change the old value. Application consider these values for computing housing allowance in payroll calculation. |

| Housing Allowance Type | You can choose your company housing allowance type calculation as fixed or percentage from here. When choosing fixed user are able to put or change values in amount option and system auto disable the other option i.e. percentage and vice-versa. System could be accept negative value in amount field but percentage field only accept positive value. |

| Housing Allowance Amount | Salary grade housing allowance in amount. |

| Housing Allowance Percentage (%) | Always calculate on earned basic salary. |

>>PROVIDENT FUND:

| Provident Fund Applicable | Option for making decision about provident fund applicable for this salary grade. When clicked all the option related provident fund are enable for enter a new value or change the old value. Application consider these values for computing provident fund in payroll calculation. |

| Deduction Type | Choose your provident fund deduction type as fixed or percentage. When choosing fixed, the value in employee and employer text boxes are consider as a amount while choosing percentage they are consider as percentage value. |

| Calculate on | Choose base for system on which provident fund value are compute in payroll calculation. Option is enable when deduction type is set on percentage. Option you can select from here between “Basic” , “Gross” or “Basic + Housing”. When choosing “Basic” system calculate the PF amount on earned basic amount, when choosing “Gross” system calculate the PF amount on gross amount, when choosing “Basic + Housing” system calculate the PF amount on a sum value of earned basic and calculated housing amount. |

| Currency | Please choose currency for provident fund. Most of time in provident fund, currency and company base currency are remain same. Choose if your organization are used to give PF in foreign currency. While clicking system display all the current company currency that application have. |

| Employee | Value of employee for the provident fund. It can be in amount or percentage, depends on making the selection of deduction type option. |

| Employer | Value of employer for the provident fund. It can be in amount or percentage, depends on making the selection of deduction type option. |

| Voluntary PF | Voluntary provident fund (VPF) is a safe option wherein you can contribute more than the PF ceiling that has been mandated by the government. This additional amount enjoys all the benefits of PF except that the employer is not liable to contribute any extra amount apart from PF ceiling. Please note that the maximum contribution towards VPF is 100% of employee basic salary. |

>>PENSION:

| Pension Applicable | Option for making decision about pension applicable for this salary grade. When clicked all the option related pension are enable for enter a new value or change the old value. Application consider these values for computing pension value in payroll calculation. |

| Deduction Type | Choose your pension deduction type as fixed or percentage. When choosing fixed, the value in employee and employer text boxes are consider as a amount while choosing percentage they are consider as percentage value. |

| Calculate on | Choose base for system on which pension value are compute in payroll calculation. Option is enable when deduction type is set on percentage. Option you can select from here between “Basic” , “Gross” or “Basic + Housing”. When choosing “Basic” system calculate the pension amount on earned basic amount, when choosing “Gross” system calculate the pension amount on gross amount, when choosing “Basic + Housing” system calculate the pension amount on a sum value of earned basic and calculated housing amount. |

| Currency | Please choose currency for pension. Most of time in pension, currency and company base currency are remain same. Choose if your organization are used to give PF in foreign currency. While clicking system display all the current company currency that application have. |

| Employee | Value of employee for the pension. It can be in amount or percentage, depends on making the selection of deduction type option. |

| Employer | Value of employer for the pension. It can be in amount or percentage, depends on making the selection of deduction type option. |

| Voluntary Pension | Option for enter the value for voluntary pension. |

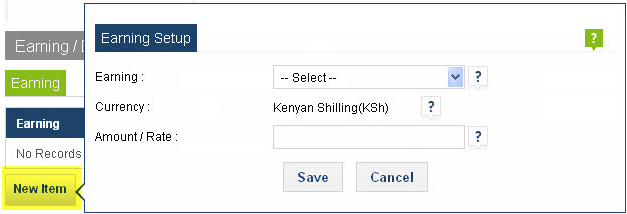

Earning / Deduction Details:

>>Earning

To add earning or deduction element in salary grade, click on “new item” button. It will open a new window of earning or deduction set-up (when “new item” button exist in earning tab system shows earning set-up window. When “new item” button exist in deduction tab system opens deduction set-up window).

New set-up window showing all earning or deduction of fixed or rate (element without having formula) type. Along with currency list & amount/rate text box option. You can insert here earning/deduction element with base or foreign currency. Added value consider as amount or rate by the nature of element calculation type.

For know more what is earning & deduction ? What is element calculation type ? How to insert element ? Please refer Earning Deduction master section.

Loan Setup:

In general loan is “A thing that is borrowed, especially a sum of money that is expected to be paid back with interest.” In corporate a loan is something that an employee repays.

Use loan set-up master to set-up loan. A loan set-up record includes the loan name and other loan-specific settings. Each loan set-up record defines the primary information needed to use it in other transaction. An loan set-up record contains the key details about the loan, such as loan name,loan interest rate, interest type, calculation of interest based on, loan interest deduction etc. This information is then leveraged by the application for any loan conducted using this loan set-up in making of loan or loan repay schedule entry.

Loan repay schedule entry is a complete table of periodic blended loan payments, showing the amount of principal and the amount of interest that comprise each payment so that the loan will be paid off at the end of its term.

| Option Name | Description | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Loan Code | Mandatory and unique field. Enter a new loan code, or the number assigned to the existing loan record being maintained. System is having mechanism to generated auto as well as user can enter desired value for loan code. Value can be acceptable as numeric, alpha numeric with prefix and suffix. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loan Name | Option to enter loan name. It is a mandatory field, could not accept blank & duplicate value. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest Rate | Option for enter the interest rate for the loan . An interest rate is the rate at which interest is paid by employee for the use of money that they borrow from company. Specifically, the interest rate is a percentage of principal paid a certain number of times per period for all periods during the total term of the loan. Interest rates are normally expressed as a percentage of the principal for a period of one year, sometimes they are expressed for different periods such as a month or a day. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest Type | Choose your loan interest type as yearly or monthly. When choosing yearly, interest rate noted an annual basis, known as the annual percentage rate (APR) for computing the monthly interest from APR rate system divided by 12 to get the monthly interest rate. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest Calculated On | There are three different interest calculation methods you can choose from for your loan set-up – reducing balance, principal (flat) and manual. When creating a new loan set-up, you will need to choose one of these methods to be associated to the loan set-up. You can see how the repayment schedules would look like for each of the methods.

Interest calculated type : Principal (Flat) This is the only method for which interest is not accrued over time. All interest and principal become due immediately upon disbursement and regardless the first repayment date. The interest due depends only on the interest rate, principal amount and time between repayments.

Interest calculated type : Reducing Balance Reducing balance methods reflect the actual cost of the loan more accurately than the principal methods as the interest is calculated on the outstanding balance. The employee will then be paying interest only on the actual amount they still hold and not on the total amount as it happens with principal methods. In this case, as the employee starts making repayments, the interest due will keep decreasing over the duration of the loan.

Interest calculated type : Manual In this case the company manual insert the value of interest. System does not calculate any value for interest. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loan Interest Deduction | Choose your loan interest deduction type as default or manual. When choosing default system will calculate the interest value other hand on manual system user has to do manual calculation for interest. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Calculate Fringe Benefit | Option for making decision for making calculation of fringe benefit tax for this loan. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Description | A option for store any other information,remarks or description. |

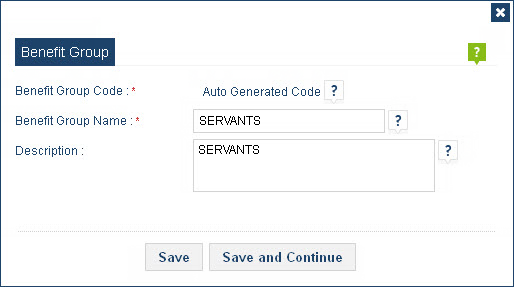

Benefit Group:

Benefit group is a group of same nature of benefits that are gathered and classed together. A benefit group record contains the key details about the benefit group detail, such as benefit group code, benefit group name & description.

You can enter the primary information for each benefit group master through this program. Use benefit group master to add, update and delete benefit group record available in the company.

| Option Name | Description |

|---|---|

| Benefit Group Code | Mandatory and unique field. Enter a new benefit group code, or the number assigned to the existing benefit group master record being maintained. System is having mechanism to generated auto as well as user can enter desired value for benefit group code. Value can be acceptable as numeric, alpha numeric with prefix and suffix. |

| Benefit Group Name | Name of the benefit group. It is a mandatory field, could not accept blank & duplicate value. |

| Description | A option for store any other information,remarks or description. |

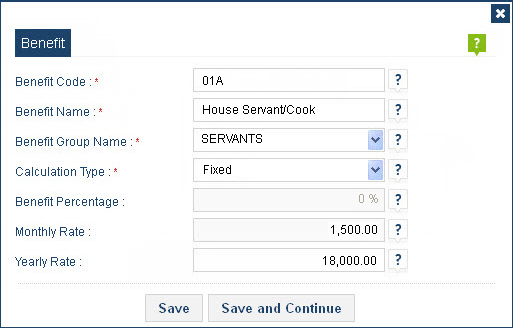

Benefit:

A benefit is a advantage or facility rendered to employee in his or her employment duration. Where an employee enjoys a benefit, the value of such benefit should be included in employee’s earnings and charged to tax.

| Option Name | Description |

|---|---|

| Benefit Code | Mandatory and unique field. Enter a new benefit code, or the number assigned to the existing benefit master record being maintained. System is having mechanism to generated auto as well as user can enter desired value for benefit code. Value can be acceptable as numeric, alpha numeric with prefix and suffix. |

| Benefit Name | Name of the benefit. It is a mandatory field, could not accept blank & duplicate value. |

| Benefit Group Name | List of benefit group name exist in company database. |

| Calculation Type | There are three different calculation methods for benefit you can choose from for your benefit master – fixed, variable and percentage. When creating a new benefit, you will need to choose one of these methods to be associated to that benefit. This information is then leveraged by the application for computing the benefit values of employee during payroll calculation. |

| Benefit Percentage & Monthly Rate & Yearly Rate | The chargeable value of a benefit, advantage or facility granted to employee by virtue of employment or services rendered should be taken as the higher of the cost to employer or fair market value of the benefit, provided that the commissioner may from time to time prescribe rates of benefits where the cost or fair market value cannot be determined. BITPLUS PayMaster application uses “benefit percentage”, “monthly rate” or “yearly rate” option to determined their values. |

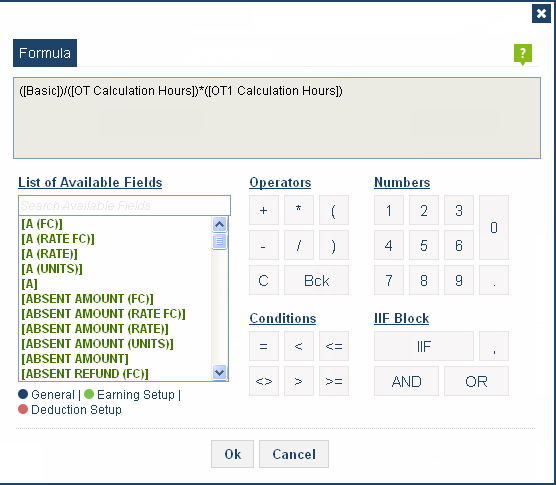

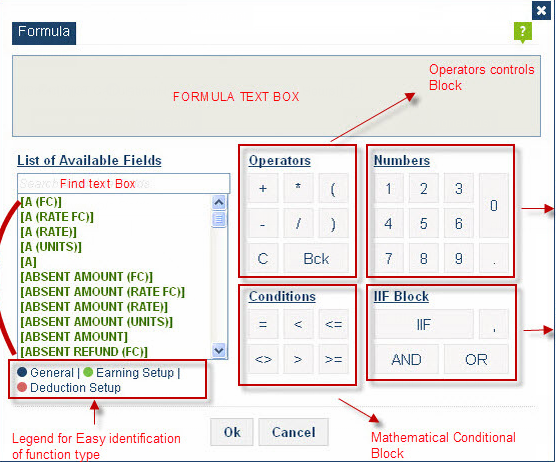

>>Formula Masters:

Use formula master option to create formulas for specify calculations for each earnings or deduction. Elements are processed during payroll runs according to the business rules for each element that you define at set-up. Many of these rules are defined in formulas, written using formula master option. Formulas specify how the payroll run should perform calculations for the element. Formula master has the function list window, which displays all functions that can be inserted into your payroll calculation. The functions are inserted with place holders to be replaced with your own values.

Use the function list window to quickly enter functions in the function box. By double-clicking an entry in the functions list, the respective function is directly inserted with all parameters.

Enter a value in find text box to search the appropriate functions in the list field below.

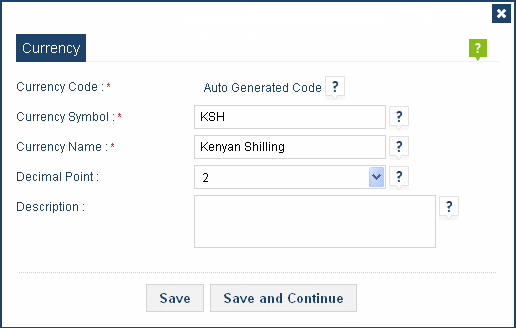

Currency

Use currency master to enter and update each currency in which your organization conducts business. You can create currencies for a specific company or global currencies for your entire organization.

Each currency record defines the primary information needed to generate financial transactions with employees. A currency record contains the key details about the currency, such as its code, symbol, name, decimal point and description. This information is then leveraged by the application for any transaction conducted using this currency.

| Option Name | Description |

|---|---|

| Currency Code | Mandatory and unique field. Enter a new Currency code, or the number assigned to the existing bank profile record being maintained. System is having mechanism to generated auto as well as user can enter desired value for Currency Code. Value can be acceptable as numeric, alpha numeric with prefix and suffix. |

| Currency Symbol | A currency symbol is a graphic symbol used as a shorthand for a currency's name, especially in reference to amounts of money. It is a mandatory field, could not accept blank & duplicate value. |

| Currency Name | Name of the Currency. It is a mandatory field, could not accept blank & duplicate value. |

| Decimal Point | Decimal precedence of the currency. A decimal mark “.” is a symbol used to separate the integer part from the fractional part of a number written in decimal form. |

| Description | A option for store any other information,remarks or description. |

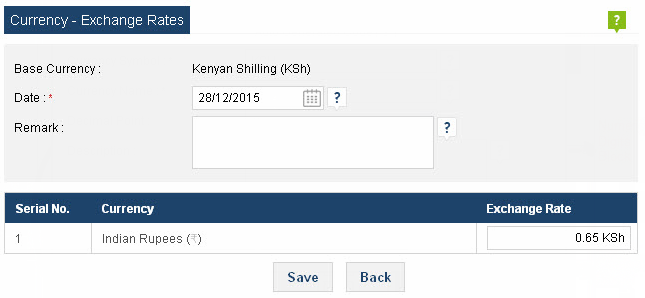

Currency Exchange Rate

The currency exchange rate functionality affects transactions throughout the entire application. As exchange rates between currencies changes (as often as daily), your transactions can be automatically revalued using the current, active exchange rates, ensuring that your monetary amounts on all your transactions are up to date.

Use exchange rate set-up master to add,update and delete record related to exchange rate set-up. Define include parameters such as base currency, effective date, remarks & exchange rate.

| Option Name | Description |

|---|---|

| Base Currency | Base currency is the primary currency used by a company. Technically this currency is also considered a reporting currency by the application as well. The base currency is unique, however, as it is the default currency used on all transactions generated within a specific company. When the application can not find another currency to use for a transaction, it calculates the amounts using the base currency defined for the organization. |

| Effective Date | Date of currencies value change. As exchange rates between currencies changes your transactions can be automatically revalued using the current, active exchange rates from this date. |

| Remarks | A option for store any other information,remarks or description. |

Coinage Setup

The coinage table shows the list of available currency denominations of the company. The coinage table is very useful when cash payment is given to the employee. The coinage table enables you round the net pay amounts paid to employees up to the lowest available coinage denomination.

- This may be useful to:

- Eliminate having to pay smaller denominations which may be inconvenient to use

- Eliminate using denominations that may not be readily available

- Present the net pay more conveniently to staff.

The net pay will be rounded upwards to the lowest denomination on the coinage table. The application sets each employee net pay up to the lowest available coinage denomination on the coinage table.

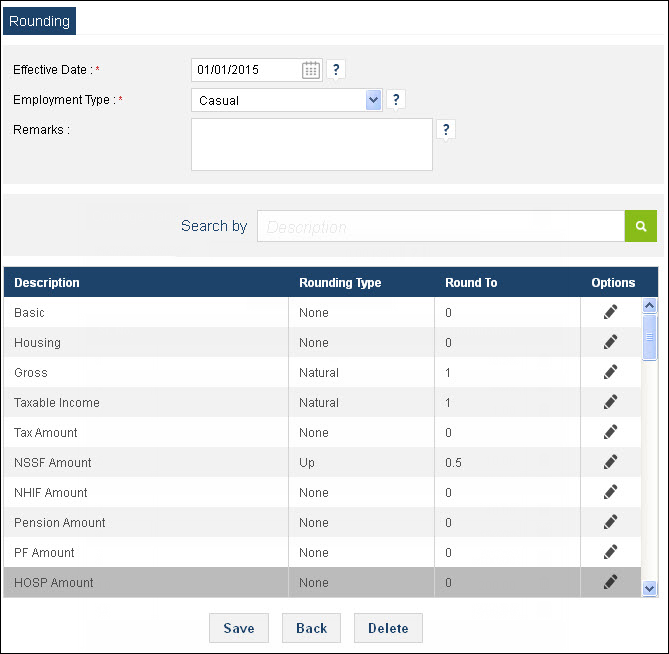

Rounding

Rounding a numerical value means replacing it by another value that is approximately equal but has a shorter, simpler, or more explicit representation; for example, replacing Kshs. 23.4476 with Kshs. 23.45

| Option Name | Description |

|---|---|

| Effective Date | Mandatory and unique field. Effective date of rounding. Transactions can be automatically rounded using the current, active rounding set-up from this date. |

| Employment Type | Employment selection option between “Regular” & “Casual” |

| Remarks | A option for store any other information,remarks or description. |

| Rounding Type |

Non : not performing any action on value for rounding. Natural : increase or decrease the digit prior to the nearest “round to” value. Up : always increments the digit prior to the nearest “round to” value. Note that this rounding mode never decreases the magnitude of the calculated value. Down : always decrease the digit prior to the nearest “round to” value. Note that this rounding mode never increments the magnitude of the calculated value. |

| Round To | Option of values to convert the digit in nearest value. |

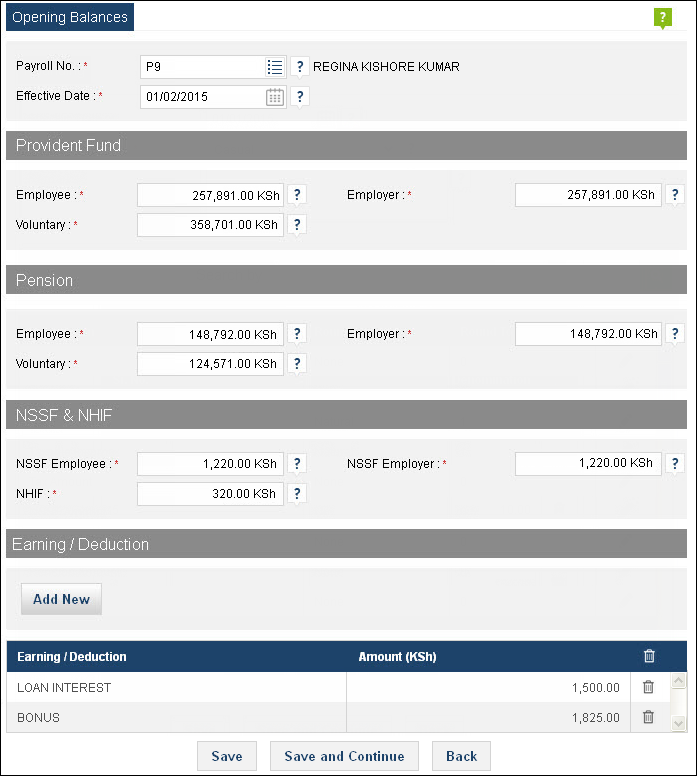

Opening Balances

It is the first entry in the employee account, when your organization is first starting up its accounts in the BITPLUS PayMaster web application. The opening balance is the amount of funds in an employee's account at the time of beginning the employee’s entry in this system. Use opening balances to add,update and delete opening records of the employee. A opening record contains the key details about the employees opening balance, such as employee PF, employers PF, voluntary PF, employees pension, employers pension, voluntary pension, employee NSSF, employers NSSF, NHIF, earning and deduction elements (which are marked to maintained balance) opening balances. This information is then leveraged by the application for further uses in calculation.

| Option Name | Description |

|---|---|

| Payroll No | Mandatory field. Payroll no of employee. You can type employee payroll no here or select it by using list. Display the list of current active employees. |

| Effective Date | Mandatory and unique field. Effective date of opening balance. On this date transactions can be automatically added to the balance of employee as a opening. |

| Provident Fund | |

| Employee | Option to enter opening balance of employee provident fund. |

| Employer | Option to enter opening balance of employee provident fund. |

| Voluntary | Option to enter opening balance of voluntary provident fund. |

| Pension | |

| Employee | Option to enter opening balance of employee pension. |

| Employer | Option to enter opening balance of employer pension. |

| Voluntary | Option to enter opening balance of voluntary pension. |

| NSSF & NHIF | |

| NSSF Employee | Option to enter opening balance of employee NSSF. |

| NSSF Employer | Option to enter opening balance of employer NSSF. |

| NHIF | Option to enter opening balance of employee NHIF |

| Earning / Deduction | |

| Earning & Deduction | Option to enter opening balance of earning & deduction elements. |

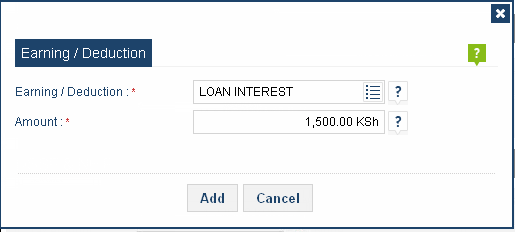

To add earning or deduction element in opening balance, click on “new item” button. It will open a new window of earning or deduction set-up. New set-up window showing all earning or deduction which is marked to maintained balance.

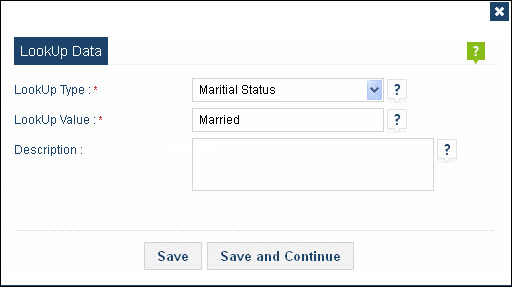

Lookup Data

Lookup data is data that remains unchanged over a long period of time. Lookup data contains information that is needed again and again in the same way. The lookup data feature enables you to define master data under various lookup type such as title, gender, marital status, phone, email,wages, qualification etc.

| Option Name | Description |

|---|---|

| Lookup Type | Option for choosing lookup type. Application have most of predefined lookup type. You can choose lookup type between title ,gender, marital status, account type, language level type, phone type, email type, address type, wages rate type & qualification type. |

| Lookup Value | Lookup value for the lookup type. It is a mandatory field, could not accept blank & duplicate value in same lookup type. |

| Description | A option for store any other information,remarks or description. |

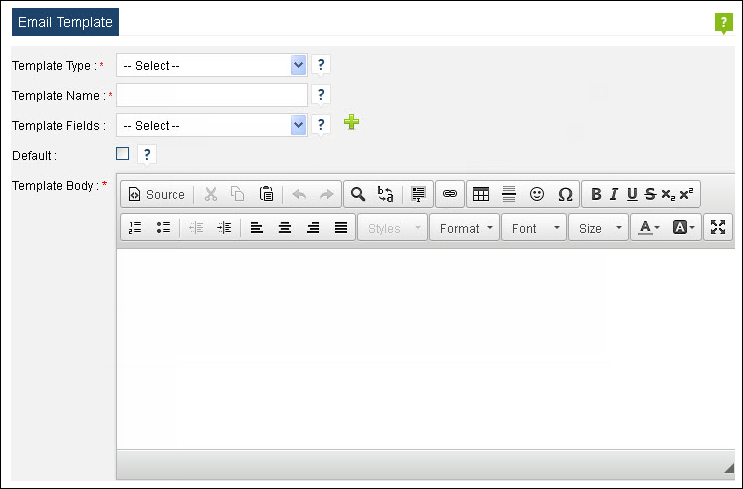

Email Template

Email templates are used for automation and consistency. In BITPLUS PayMaster, you can create different types of email templates in text or html. You can include text, images and attached files to email templates. These email template can be used when sending your payslip, information, message to your employee or greetings to your clients, suppliers and friends. Text and html templates can also be used when you send mass email. A button to check the spelling of your template is available for text templates.

BITPLUS PayMaster email templates can also be populated with merge codes. This is useful for customizing the email with information, such as employee name, payroll no, employee PIN etc. it saves creation time, because the same template can be used every time.

A few templates create by default when you open your BITPLUS PayMaster application. You can edit settings for all email templates as per your requirements.

| Option Name | Description |

|---|---|

| Template Type | Choose the items from template type between “p9a report template” and “employee payslip template”. You are not able to create any more email template type in BITPLUS PayMaster application. These template are auto create on company creation. |

| Template Name | Name of the template. It is a mandatory and unique field, could not accept blank & duplicate value. |

| Template Field | Click on the this option to view the available merge codes that you can use inside the email template. When you insert a merge code it is replaced by the value it represents. For example, ${employeename}, is replaced with the employee full name. |

| Default | Check box option to determined the default template. At same time only one email template could be default. It is used when “p9a report template” or “employee payslip template” template type have many template records under it. Application will send the default template in auto email. |

| Template Body | Area to write the text, message, attached images, files, add merge codes for email template. |

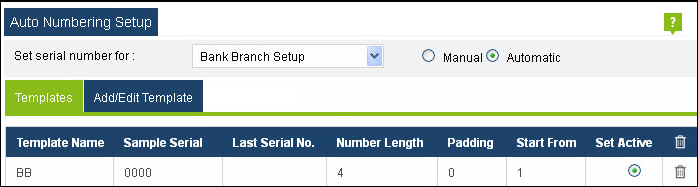

Auto Numbering Setup

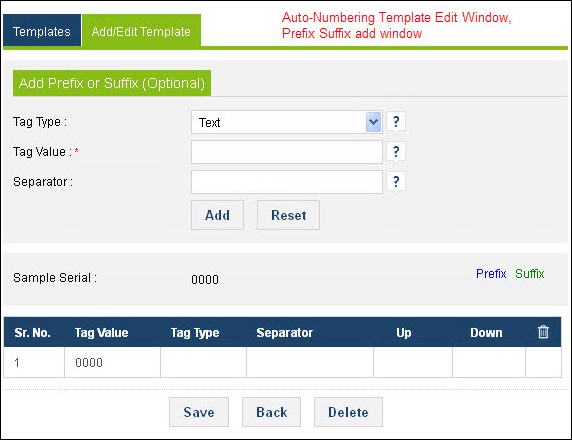

Automatic numbering is a very useful and time saving feature of the BITPLUS PayMaster. The auto-number set-up can be added to your entry window to generate an automatically incremented counter for each record that you insert. This type of column is useful when you want to assign record number without manually typing them in.

As the entry time you can create an auto-number column, convert an existing code no column into an auto-number column, and use prefix or suffix to add dynamically-generated code into the numbering sequence. You can also reset the auto-number in the event your numbering schema changes.

You can set same or different logic for generating auto-number for each entry window. You can use prefix, suffix, separator, tag, padding, text, number, date, company name,company code,company short name & other columns to generate the auto-number, auto-number logic can be change at any time. You can add,change, remove any prefix,suffix,separator,padding, text etc. at any time in the system. You can also shift from manual to auto-number system or vice-versa at any level of the system.

Note: as with all entry window, you can only have one auto-number column.

| Option Name | Description |

|---|---|

| Set Serial for | Show list of all master entry window. You can select a master entry option and set auto-number template as per your need. |

| Manual/Automatic | Option to decide how to code text box get data. When choose “manual”, system allows you to enter value in code text box of master entry form. However code text box still remain mandatory and unique field. You cannot add duplicate value in it. When choose “automatic”, system auto generated the unique code in text box of master entry form based on condition you provide in template. |

| Template Name | Template name for master entry form. You can create many template for a master entry form but only one template can be active for a time. System use the active template for generate auto-number in automatic mode. Template name should be unique for selected master entry form. |

| Sample Serial | Show the sample of auto-numbering code, show how does system generate code in auto mode. |

| Last Serial No | Show the last generated serial no in automatic mode. |

| Number Length | Display the number length of template you entered. |

| Padding | Digit you want to add before your auto serial number in master entry form. |

| Start From | Starting no for auto-number system. |

| Set Active | Click for to active the template for applying the auto-number system for code text box in selected master entry form. |

| Delete | Option to delete the template |

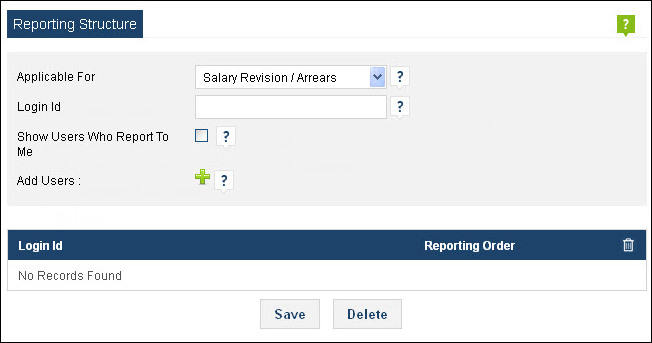

Reporting Structure

Reporting structure refers to the authority relationships in a company -- who reports to whom. For small businesses with only a couple of employees, that structure is often self-evident: everyone reports to the owner. With enough new employees, though, coordinating everyone’s efforts will likely demand a formal organizational structure. This framework establishes who is in charge of different tasks, departmental areas and the organization as a whole. These authority boundaries and the relationships among people in authority serve to create the reporting structure.

| Option Name | Description |

|---|---|

| Applicable For | Show list of all master entry window. You can select a master entry option and set auto-number template as per your need. |

| Login Id | Option for selecting the reporting user name. It will create the vertically hierarchy reporting structure. The vertical aspect of organizational structure creates a power hierarchy. Employees only have the authority to do their individual jobs, so they’re at the bottom of the hierarchy. They report to operational supervisors, who may themselves require supervision by middle managers. This increasing power continues up to the top of the reporting structure, stopping at the owner or chief executive officer. On an organizational chart, lines connect positions to their respective managers. Operational, middle and top management are all said to have line authority over those they directly supervise. The vertical relationships in the reporting structure are the chain of command. |

| Show Users Who Report to Me | Option to show the vertically hierarchy reporting structure. |

| Add Users | Add the user for reporting. |

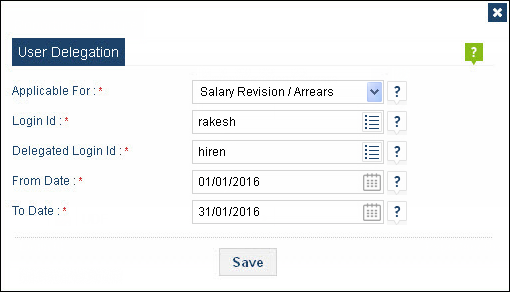

User Delegation

User delegation is the process of a computer user handing over their authentication credentials to another user for the mention time or duration. In role-based access control models, delegation of authority involves delegating roles that a user can assume or the set of permissions that he can acquire, to other users. Enable delegated user to manage users in specified roles and all subordinate roles, assign specified profiles to those users, and log in as users who have granted login access.

| Option Name | Description |

|---|---|

| Applicable For | Option to choose delegation applicable option. In BITPLUS PayMaster version 1.0.0.1 user delegation is applicable for only for “salary revision” and “arrears”. |

| Login Id | User login id for user rights are transfer to. Login id and delegated login id cannot be same. Inactive login id user rights can not be transfer to delegated login id. |

| Delegated Login Id | Option to choose delegated login id. Login id and delegated login id cannot be same. Inactive login id can not be use as delegated login id. |

| From Date | Starting date of applicable of delegation rights. |

| To Date | Ending date of applicable of delegation rights. |

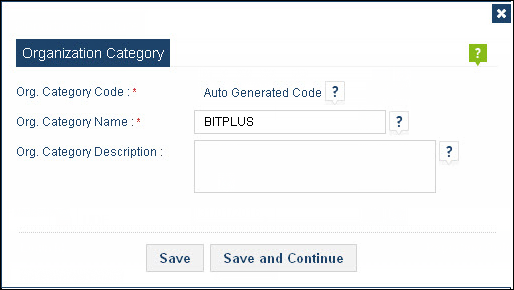

Organization Category

Use this option to enter organization category. Organization is an entity, such as an institution or an association, that has a collective goal and is linked to an external environment.

Use organization category to add, update and delete record related to organization category. You enter the primary information for each organization category through this program. Items you define include parameters such as organization category code, organization category name and organization category description

Organization category option shows when system are linked with BITPLUS HR module.

| Option Name | Description |

|---|---|

| Org. Category Code | Mandatory and unique field. system is having mechanism to generated auto as well as user can enter desired value for org. Category code. Value can be acceptable as numeric, alpha numeric with prefix and suffix |

| Org. Category Name | Name of the org. Category. It is a mandatory field, could not accept blank & duplicate value. |

| Org. Category Description | A option for store any other information, remarks and description. |

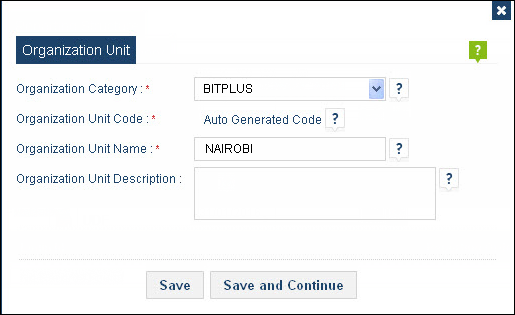

Organization Unit

Organization units are functional units in an enterprise. It is a link part of organization category and differ from other units in an enterprise.

| Option Name | Description |

|---|---|

| Organization Category | List of organization categories exist in system. |

| Organization Unit Code | Mandatory and unique field. system is having mechanism to generated auto as well as user can enter desired value for organization unit code. Value can be acceptable as numeric, alpha numeric with prefix and suffix. |

| Organization Unit Name | Name of the organization unit. It is a mandatory field, could not accept blank & duplicate value. |

| Organization Unit Description | A option for store any other information, remarks and description. |